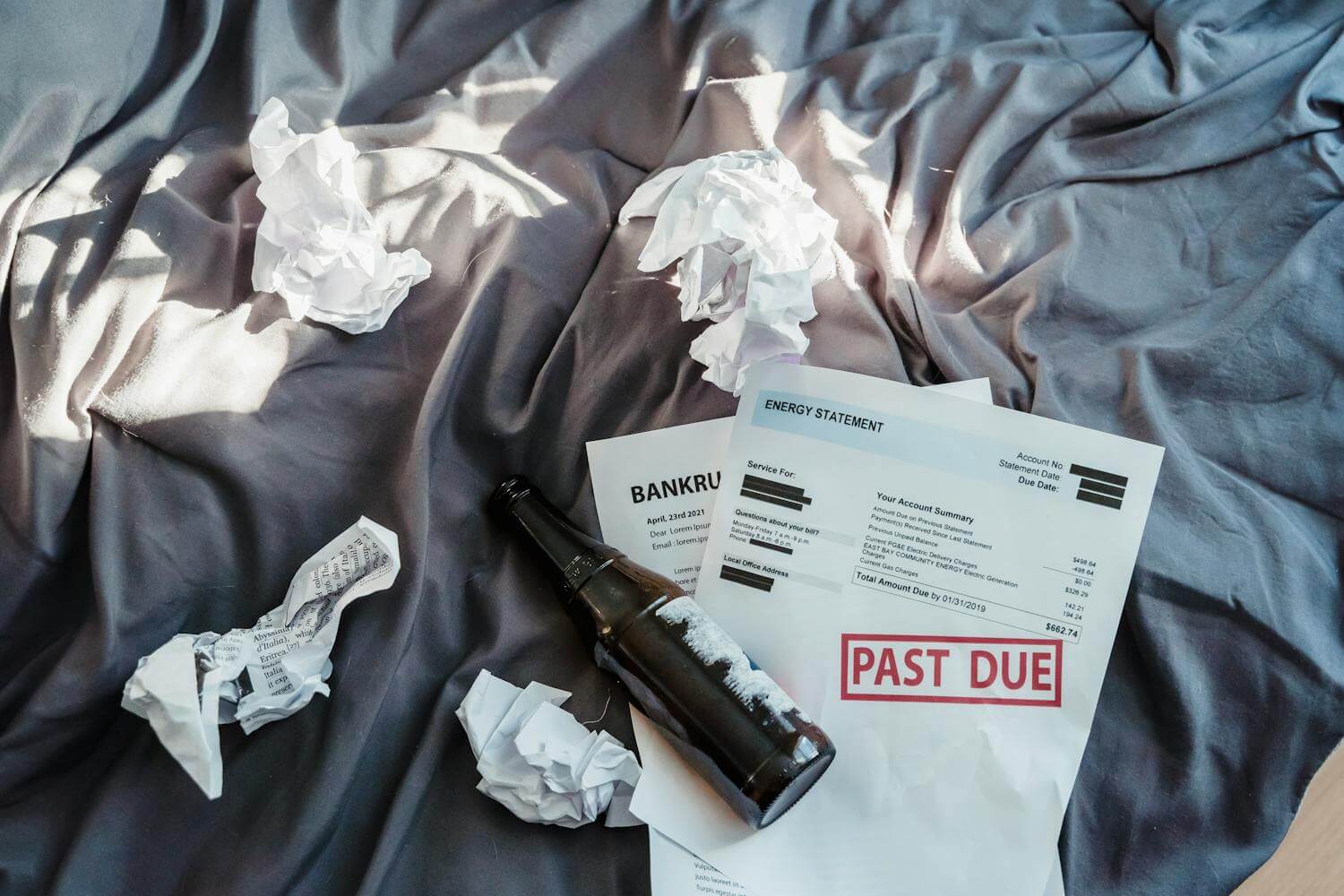

When your ex-husband files for bankruptcy, it can ripple through your financial and emotional well-being, especially if you’re entangled in post-divorce settlements or financial arrangements.

This situation raises numerous questions about the impact on property settlements, spousal support, and other financial obligations between you and your ex-partner.

Let’s dive into the complexities of this scenario and understand the implications for your financial future.

The Impact on Property Settlements

When an ex-husband declares bankruptcy, it significantly affects the property settlement process. Bankruptcy essentially means that a trustee is appointed to manage the bankrupt individual’s financial affairs, including assets that could have been part of a property settlement with you.

This doesn’t necessarily mean you’ll lose everything, but it does complicate matters.

Key Takeaway 🔑: The involvement of a bankruptcy trustee can alter the landscape of property settlements, prioritising creditors and potentially reducing the assets available for division.

Spousal Maintenance and Support

Bankruptcy does not automatically nullify spousal maintenance obligations. However, your ex-husband’s capacity to continue making payments might be affected. It’s crucial to understand that while unsecured debts can be wiped out in bankruptcy, obligations like child support and spousal maintenance are treated differently.

Key Takeaway 🔑: Spousal maintenance obligations may remain, but the practical ability to pay can be significantly impacted by bankruptcy.

Also read: Who Pays for Child Health Insurance After Divorce?

Need a Lawyer?

Debts and Liabilities

If you’re jointly liable for any debts with your ex-husband, his bankruptcy could leave you solely responsible for these liabilities. Creditors may seek repayment if the debt was incurred jointly or you acted as a guarantor. Assessing your vulnerability regarding joint debts and swiftly seeking financial and legal advice to mitigate your exposure is essential.

Key Takeaway 🔑: Joint debts can become your sole responsibility, highlighting the importance of understanding your financial entanglements and seeking advice.

Tips for Protecting Your Financial Interests

Protecting your financial health becomes paramount when navigating the financial turbulence of an ex-husband’s bankruptcy. Here are some actionable tips to help you stay afloat and secure your financial future:

- Seek Legal and Financial Advice: Consult with a financial advisor and a family law expert who understands the intricacies of bankruptcy and its impact on family law matters. Tailored legal advice can provide a roadmap to navigate this complex situation.

- Renegotiate Financial Agreements: Consider renegotiating any financial agreements that may be affected by the bankruptcy. This could involve spousal support, property settlements, or joint debt arrangements.

- Court Orders for Asset Protection: Explore the possibility of obtaining court orders to protect your assets and income. This proactive step can safeguard your financial interests from being adversely affected by the bankruptcy proceedings.

- Stay Informed and Proactive: Keep yourself informed about your rights and the bankruptcy process. Understanding the potential impacts and being proactive in your financial planning can make a significant difference in managing the situation effectively.

Key Takeaway 🔑: Navigating an ex-husband’s bankruptcy requires legal guidance, strategic financial planning, and proactive measures to protect your assets and income. Equip yourself with the proper knowledge and support to safeguard your financial interests during these challenging times.

If My Ex-Husband Filed Bankruptcy What Happens: Seek Legal Advice

An ex-husband’s bankruptcy is a complex issue that intertwines with family law, affecting property settlements, spousal support, and shared debts.

While it presents challenges, understanding your rights and obligations, along with strategic legal advice, can help you manage the situation and protect your financial future.

Remember, you’re navigating through a difficult time, but with the right support and information, you can emerge with your financial health intact.

Navigating the aftermath of an ex-partner’s bankruptcy is undoubtedly challenging, but armed with the proper knowledge and legal advice, you can make informed decisions to safeguard your financial well-being.